Fill Out the Paperwork. Access any cash first.

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

There are many online brokerages offering Roth IRA accounts and some are better than others.

How to open a roth ira fidelity. However many of its own Fidelity-branded mutual funds have 2500 minimum deposit. You enter your basic information like your name and email. However you can buy ETFs that are designed to move in the opposite direction as a stock market index or other benchmarks.

As a result you cant open a joint Roth IRA with a spouse. We put together a list of the best brokers for Roth IRAs to make the process easier. Regarding core positions dont worry too much about these because you are going to want your money invested in ETFs mutual funds stocks etc.

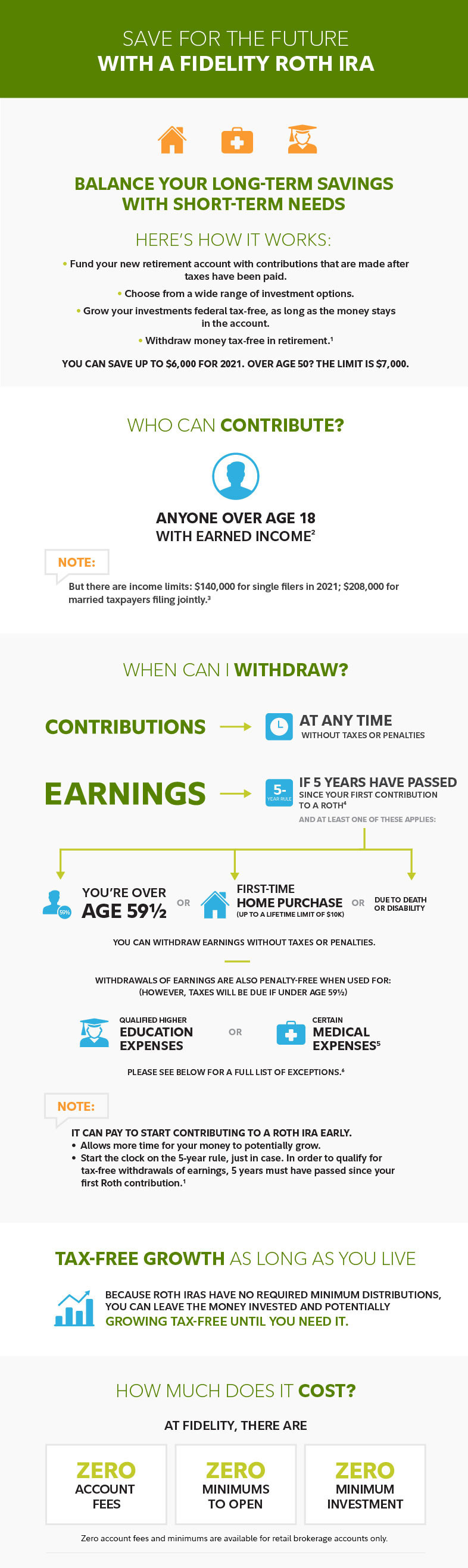

Roth IRAs and Taxes. You must be a legal adult at least 18 years old and have a Social Security number or a tax ID. However there are strict rules when it comes to how much you can contribute to your Roth IRA.

The company offers commission-free trading on individual stocks and thousands of ETFs. Income Limit and Backdoor Roth IRA. You can choose to receive a check or have the funds in your Roth account sent via electronic fund transfer to another account.

The IRS has certain requirements such as age income and marital status that impact how much you can contribute as well as how much you may be able to deduct. To fund an account. If youre over 50 those limits are raised to 7000 per year.

Contributions to a Roth IRA are made with after-tax dollars which means your money can grow tax-free. In mid-2020 Roth IRAs were held by 263 million US. In recent years the Roth IRA has skyrocketed in popularity with Americans looking to stash money away for retirement.

When you invest in a traditional IRA or a 401k or any retirement investment other than a Roth IRA you invest the money before youve paid taxes on. If youre taking withdrawals. All are very decent options.

If income is sufficient one can also open a Spousal Roth IRA and contribute another 6000. You and your spouse can have separate Roth. Fidelity may also charge a 50 account close out fee.

Fidelity doesnt require a minimum deposit to open an IRA. Vanguard is the OG of index funds literally invented them. Youll be asked what kind of account you want for this example I chose a Roth IRA.

Opening a Roth IRA can be a smart move if you want to invest for retirement and save money on taxes later in life. Identifying information Social Security number date of birth etc Contact information legalmailing address email address phone number Employment information if applicable occupation employers name and address Identifying information for the minor account owner. Margin trading is a riskier type of investing that is best suited for advanced traders.

For instance selling stocks short in a Roth IRA isnt typically allowed. Once you go to the Fidelity homepage you can create an account. The financial institution you open the account with is called the custodian because it takes custody of your money.

To open an account. The most important thing you need to look at is the expense ratio which is usually 003 most of Vanguards index funds are about this expense ratio. And not sitting in the core position.

Anyone with earned income can open a Roth IRA and contribute up to 6000 per year for the 2020 tax year. Youll often hear that the Roth IRA is the best retirement savings plan out there and there are plenty of good reasons to fund one. Mail the authorization to the address on the form.

Step-by-step with screenshots of how to open and set up an account Step 1. With Ally investors can open a Roth IRA without a minimum balance requirement and fund the account easily by linking to any other bank or credit union. IRA stands for individual retirement account which means only individuals can own IRAs.

Households or 205. Understand which IRA to open and fund. But Roth IRAs have their drawbacks and so before you open one.

Meanwhile If you want to take out earnings without a tax or penalty youll need to have had the account open for at least five years. Theres a 15 fee for an electronic funds transfer. Like many platforms Ally charges a contract fee for options trading 050 per trade.

At your age 500 a month into a Roth is an extremely smart decision that sets you apart from your peers and Fidelity is as good as it gets in terms of financial firms you can pick. In terms of how to open a Roth IRA you can open one through Vanguard Schwabb Fidelity Ameritrade.