You can download the form from the IRS website. If you file it with the joint tax return or amended a joint tax return then it should go to the IRS center for.

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Put an digital signature on your injured spouse form.

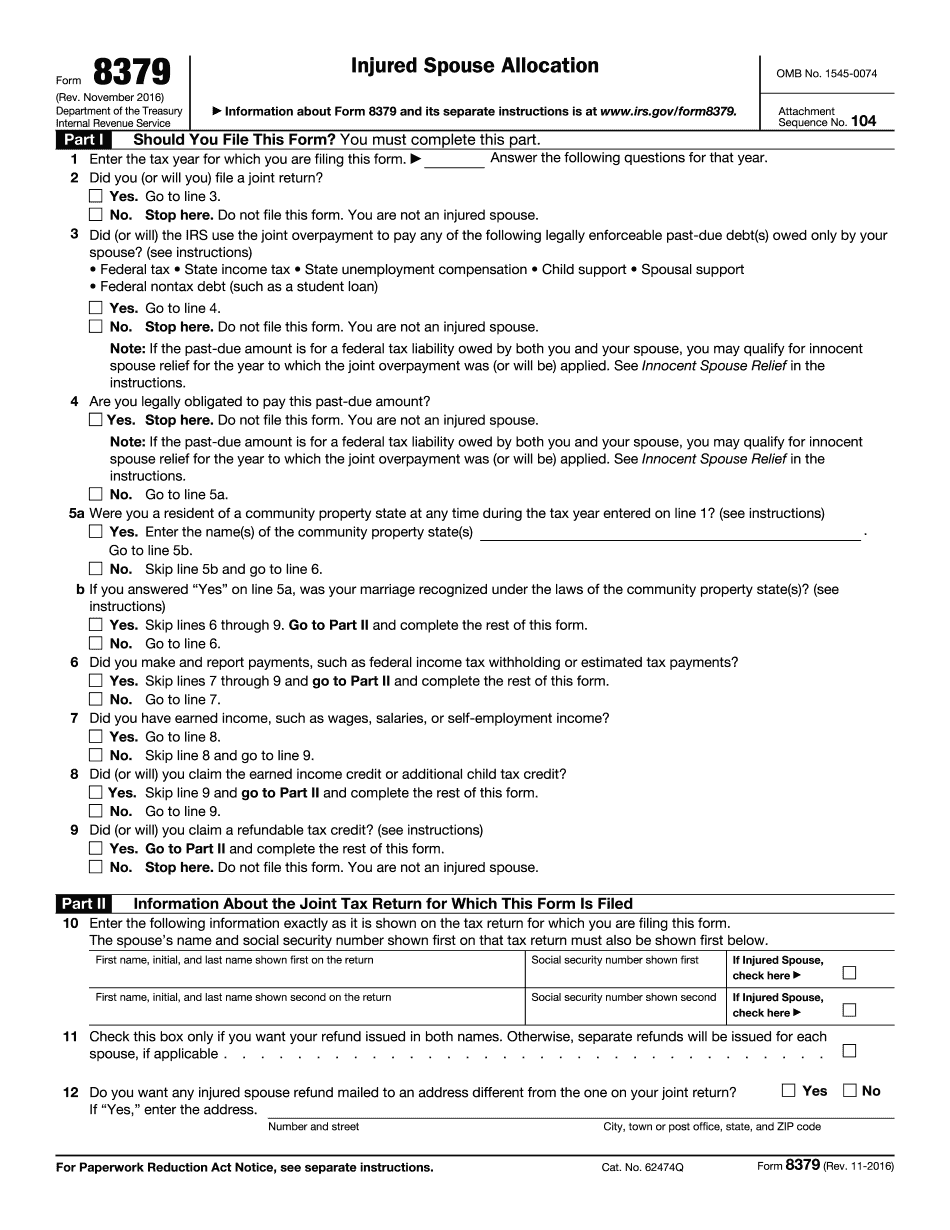

How to file an injured spouse form on turbotax. Tips The IRS makes a determination to see what portion of the child tax credit should be attributed to your income and what percentage should be attributed to your spouses income ensuring that only a portion of the told credit will be garnished. Be sure to attach copies of all 1099 forms and your W-2syour own and your spouses. If spouses file a joint tax return and a refund is applied to one spouses past-due debts the injured spouse can file Form 8379 to get their share of the refund.

If you believe youre an injured spouse you can file the federal Form 8379 for each year youre seeking relief. Filling out the form. Write or enter Injured Spouse in the top left corner of the first page of the joint return.

A couple can file Form 8379 along with their joint tax return if they expect their refund to be seized. You need to file Form 8379 for each year youre an injured spouse and want your portion of the refund. Just add our Tax Pro Review service and a tax pro will help you finish your return including your Form 8379.

An injured spouse form can be. You may complete the Injured Spouse Form Form 8379 within the program. How To File Injured Spouse Form On Turbotax McKinney TX469262-6525 Make an Appointment by Calling reliable tax resolution services Do you have tax expenses.

PDF editor will allow you to make adjustments to your injured spouse form. If you file Form 8379 with a joint return electronically the time needed to process it is about 11 weeks. Submit the form later the IRS can process Form 8379 before an offset occurs or after you have received a letter from the IRS or other agency about the tax refund offset.

Click the drop-down arrow next to Tax Tools lower left of your screen. Printable while using the assistance of Sign Tool. Injured Spouse Claim and Allocation.

Open or continue your return. If youre filing with HR Block you wont need to complete this form on your own. Complete and file IRS Form 8379 if you think youre entitled to your share of a refund that was intercepted to pay your spouses debt.

An injured spouse claim must be made when filing a tax return to protect the refund of the spouse who does not owe the IRS or any other agency that would off. If you file Form 8379 with a joint return on paper the time needed is about 14 weeks. Distribute the ready blank by way of electronic mail or fax print it out or download on your gadget.

To enter information for the Injured Spouse Allocation in TurboTax. File Form 8379 with your amended Form 1040x joint tax return Note. If you file Form 8379 by itself after a joint return has already been processed the time needed is about 8 weeks.

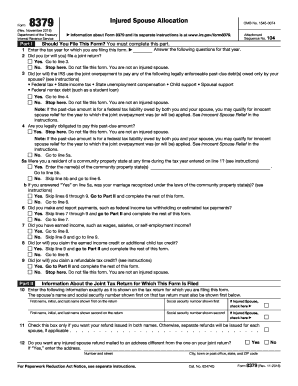

In the search box enter injured spouse and then select the Jump to link in the search results. Injured Spouse Allocation Form Screenshot from IRS If you file a paper tax return you can include Form 8379 with your return write INJURED SPOUSE at the top left corner of the Form 1040 1040A or 1040EZ. You may qualify as an Injured Spouse if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for.

To file as an injured spouse youll need to complete Form 8379. In the pop-up window. IRS will process your allocation request before an offset occurs.

If your return isnt open youll need to sign in and click Take me to. You file an injured spouse allocation form with the IRS or your states treasury department. Alternatively the injured spouse can file it separately from the return if they find out after they file that a refund was seized.

Open continue your return in TurboTax Online. If you file Form 8379 with your joint return attach it to your return in the order of the attachment sequence number located in the upper right corner of the tax form. The form has four parts.

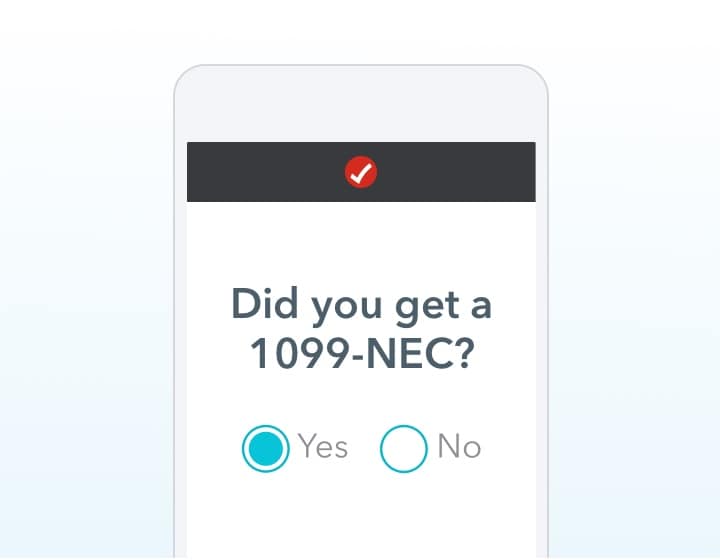

The instructions will walk you through the process step-by-step. The form can be filed electronically or by mail along with your tax return or on its own after you have filed your taxes. Yes you can file Form 8379 electronically with your tax return.

Enter Injured Spouse in the upper left corner of page 1 of the joint return. To file this form in TurboTax. Once blank is finished click Done.

Injured spouses can file a claim to part of their refund on a joint return. If youre an injured spouse you must file a Form 8379 Injured Spouse Allocation to let the IRS know. You can file this form before or after the offset occurs depending on when you become aware of the separate debt and can file it with your electronic tax return.

Answer Yes to Do you want to claim innocent or injured spouse relief. If you file a Form 8379 Injured Spouse Allocation Form by itself then you should mail it to the IRS center where the original joint tax return was filed.

Turbotax 2019 Deluxe State Download 38 99

Turbotax 2019 Deluxe State Download 38 99

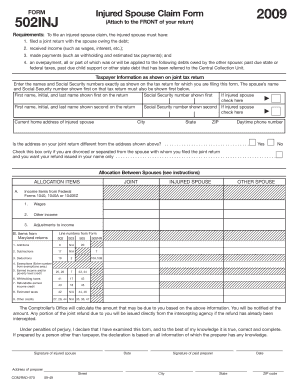

Injured Spouse Form Fill Out And Sign Printable Pdf Template Signnow

Injured Spouse Form Fill Out And Sign Printable Pdf Template Signnow

Turbotax Home And Business State 2020 Download 63 99

Turbotax Home And Business State 2020 Download 63 99

Turbotax Home Business Cd Download 2020 2021 Tax Software For Personal Business Taxes

Turbotax Home Business Cd Download 2020 2021 Tax Software For Personal Business Taxes

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Amazon Com Turbotax Deluxe Federal Efile State 2009 Software

Amazon Com Turbotax Deluxe Federal Efile State 2009 Software

How To Fill Out Tax Forms On Turbotax 2020 With Easy Steps

How To Fill Out Tax Forms On Turbotax 2020 With Easy Steps

Amazon Com Old Version Turbotax Deluxe Fed Efile State 2013 Software

Amazon Com Old Version Turbotax Deluxe Fed Efile State 2013 Software

Irs Form 8379 Fill Out And Edit Online Pdf Template

Irs Form 8379 Fill Out And Edit Online Pdf Template

Taxact Vs Turbotax 2021 Nerdwallet

Taxact Vs Turbotax 2021 Nerdwallet

8379 Injured Spouse Allocation Youtube

8379 Injured Spouse Allocation Youtube

Fillable Online Md Injured Spouse Claim 2015 Form Fax Email Print Pdffiller

Fillable Online Md Injured Spouse Claim 2015 Form Fax Email Print Pdffiller

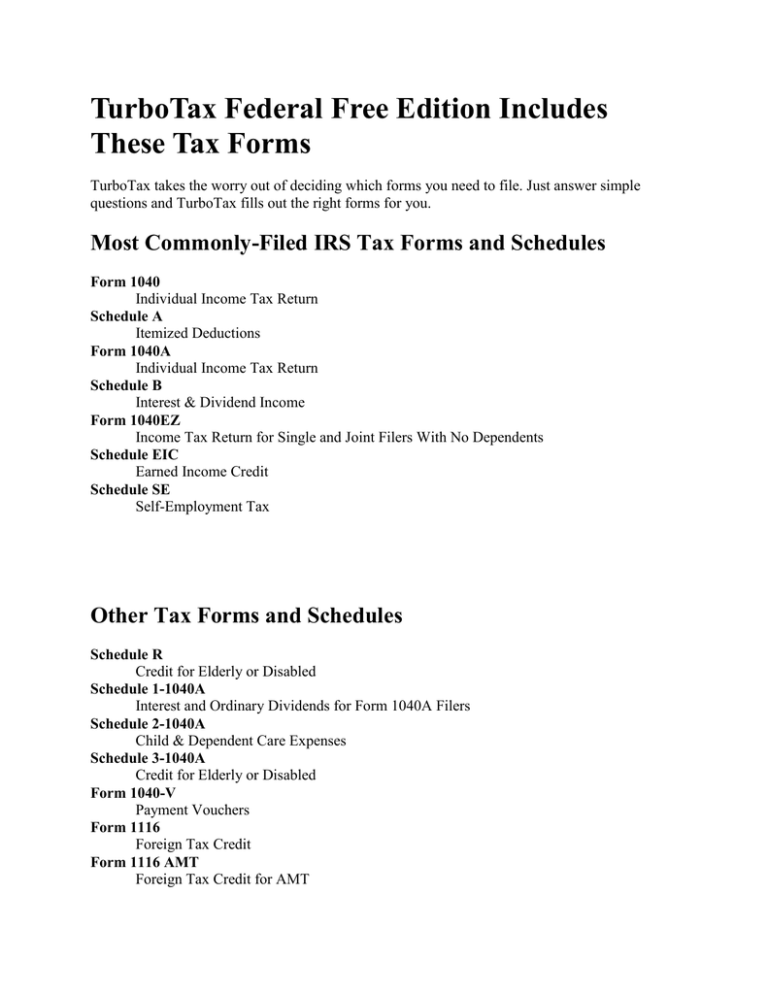

Turbotax Federal Free Edition Includes These Tax Forms

Turbotax Federal Free Edition Includes These Tax Forms

What Is Irs Form 8379 Injured Spouse Allocation Turbotax Tax Tips Videos

What Is Irs Form 8379 Injured Spouse Allocation Turbotax Tax Tips Videos

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.