If you dont see federal income taxes deducted from your paycheck your filing status exemptions or allowances may be the reason. The White House has.

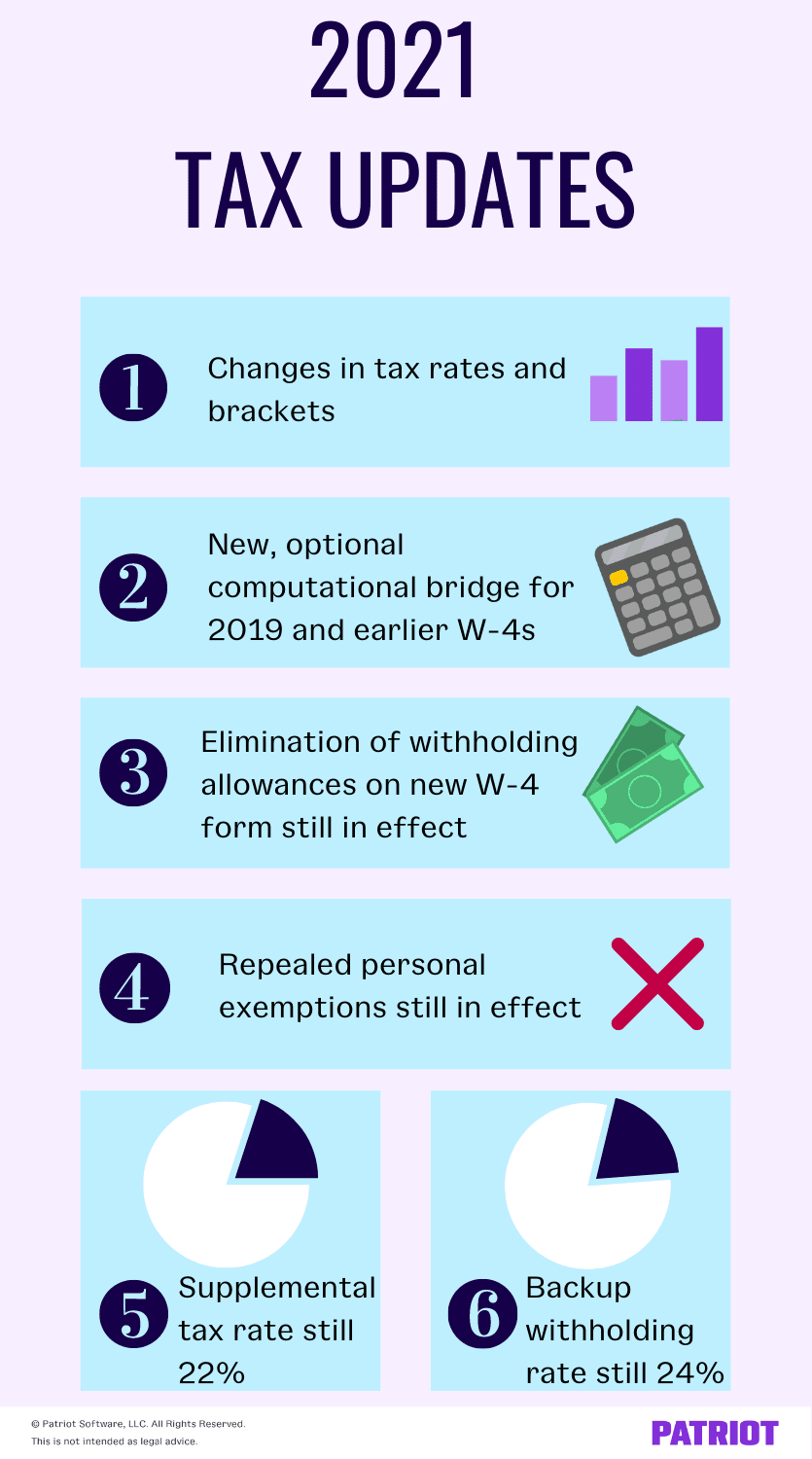

2021 Income Tax Withholding Tables Changes Examples

2021 Income Tax Withholding Tables Changes Examples

If youre looking at.

/ScreenShot2021-02-05at6.15.36PM-5e31046e8de14a21a3719fd399a682b3.png)

Why are they not taking federal taxes out. But workers may have to repay the money next year. Here are some steps to contact support. Looking at W-4 Adjustments.

The gross wages of the employees last payroll are too low. Click Help at the top menu and select QuickBooks Desktop Help. Why Arent They Taking Out Enough Federal Taxes from My Paycheck.

Some employees will soon see a boost in take-home pay. Window enter a topic. You dont make enough income.

Your employer calculates and withholds your federal income tax based on entries you make on your W-4 withholding allowance certificate which you typically fill out when you start a job. The deferment is not an actual tax cut and because the deferment was done via executive order rather than an act of Congress the taxes will need paid back by April 30 2021. If your situation is that no federal taxes were taken out of your paycheck youll still have to pay this penalty although it is a relatively small one based on a.

Your employer bases your federal tax withholding on your tax filing status and the number of. There are several reasons why payroll taxes arent calculating. Im here to help find out why payroll taxes arent calculating QuickBooks Desktop.

You can use the official IRS annual tax guide to find out how much money should be deducted from your paycheck based on your filing status pay period and any deductions. Why Are There No Federal Taxes Taken Out of My Paycheck. The amount of federal income tax you owe largely depends on what your income.

Employers are supposed to withhold Social Security tax Medicare tax and federal income tax from your pay. Specifically they must have no past or anticipated tax burden. For instance if you intend to roll your Traditional IRA withdrawal to another.

Federal income tax withholding is driven by the number of allowances you claim on Form W-4. If you see that your paycheck has no federal tax withheld it could be because you are exempt. Failure to withhold can cause an employer to incur deposit penalties interest and failure to file fees.

June 6 2019 944 AM Yes they are required to take federal withholding based on the information you supply on the Form W4. The total annual salary exceeds the salary limit. The total annual salary exceeds the salary limit.

Here are a few reasons why federal income tax might not be withheld from your paycheck. Ensure to run the latest payroll update to keep your taxes updated. When the gross earnings on your paycheck are too low based on the W4 then no federal withholding is required.

You probably received a Form 1099-MISC instead of a W-2 to report your wages. Social Security and Medicare taxes are withheld according to a flat percentage of your wages. The Trump administration has given employers the option to stop collecting payroll taxes.

Because your total income tax obligation for the year is affected by many things including marital status tax credits and deductions payroll tax withholding etc the tax rules allow you to waive federal tax withholding on your IRA withdrawal or elect an additional amount to be withheld. If youre considered an independent contractor there would be no federal tax withheld from your pay. The filing status you claim on Form W-4 affects federal income tax withholding.

These are the possible causes that may affect the tax calculation on your employees paycheck. The gross wages of the employees last payroll are too low. If you underpaid taxes on your unemployment benefits and never received your stimulus payments those missing funds could be used to offset the balance due Schreiber says.

Why Arent Federal Taxes Being Withheld From My Pay. Theyll be able to take a closer look at the issue and investigate further why the federal withholding is not taking taxes. For example if no federal taxes were taken out of the paycheck in 2020 because the employee already had an exemption or owed no taxes the previous tax year and expects a similar situation in 2021 that employee may be exempt from federal withholding in the current tax year.

Your withholding might also be off if you work multiple jobs and claimed exemptions on all of. The tax table is not updated. If the same thing happens I recommend contacting our QuickBooks Care Support.

This will allow you to possibly pinpoint the cause for a. Why Arent They Taking Out Enough Federal Taxes From My Paycheck. Here are some possible reasons why your employer did not withhold federal taxes or even state taxes.

In the Have a Question. If you claim too many withholding allowances on your W-4 you could have an insufficient amount withheld from your check. The Internal Revenue Service oversees the collection of these taxes.

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Taxes Federal State Local Withholding H R Block

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Paying Social Security Taxes On Earnings After Full Retirement Age

Paying Social Security Taxes On Earnings After Full Retirement Age

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png) Tax Avoidance And Tax Evasion What Is The Difference

Tax Avoidance And Tax Evasion What Is The Difference

/ScreenShot2021-02-05at6.15.36PM-5e31046e8de14a21a3719fd399a682b3.png) Form W 4 Employee S Withholding Certificate Definition

Form W 4 Employee S Withholding Certificate Definition

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

What Are The Tax Brackets H R Block

What Are The Tax Brackets H R Block

/standard-deduction-3193021-HL-9ef8b7499d924df793cc368b688baa7a.png) Standard Tax Deduction What Is It

Standard Tax Deduction What Is It

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png) Tax Guide For Independent Contractors

Tax Guide For Independent Contractors

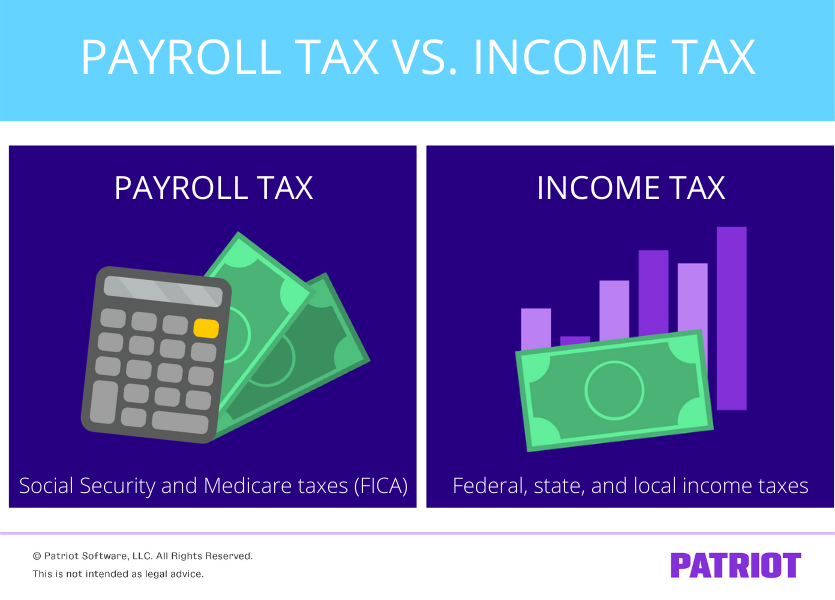

How Are Payroll Taxes Different From Personal Income Taxes

How Are Payroll Taxes Different From Personal Income Taxes

If My Job Did Not Take Out Federal Income Taxes Does That Mean I Pay

If My Job Did Not Take Out Federal Income Taxes Does That Mean I Pay

Income Tax Paycheck Withholding Basics Smart About Money

Income Tax Paycheck Withholding Basics Smart About Money

/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.