How Owner Financing Works. Owner financing may also take place in case the home buyer is unwilling to pay the prevailing market rate of interest.

Owner Financed Mortgage Owner Financing Business Notes

Owner Financed Mortgage Owner Financing Business Notes

Learn what impacts your rate and how to find the best rental property financing.

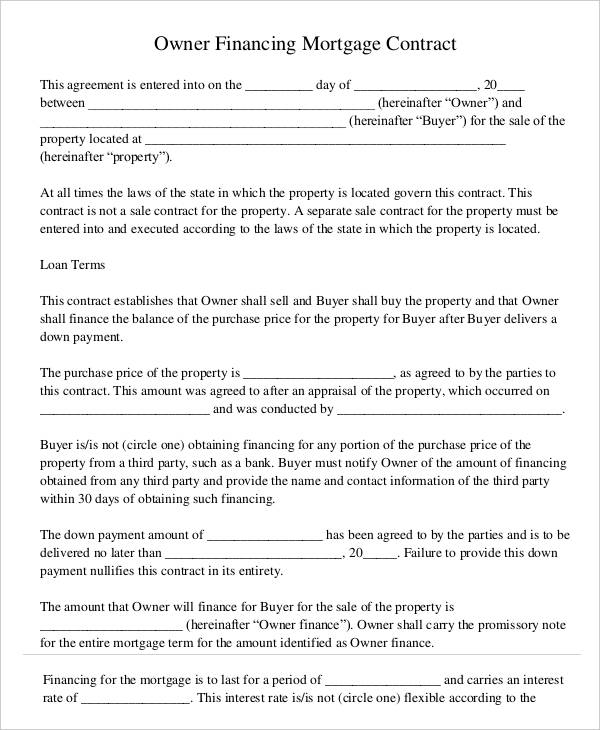

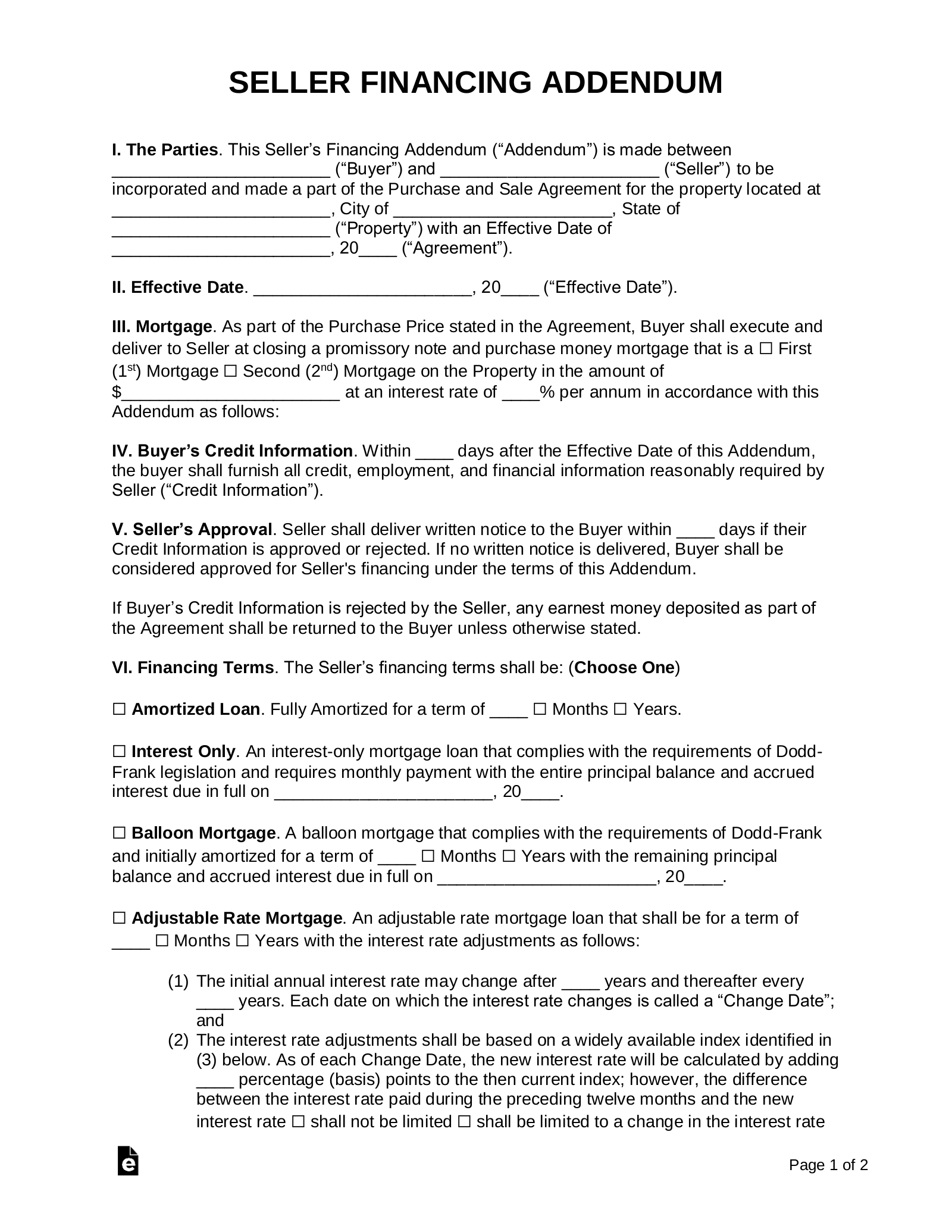

What is the going interest rate for owner financing. The seller takes on some risk by holding financing and he or she may charge a higher interest rate to offset this risk. Youre not a Realtor so you dont have to follow the law. This includes an agreeable payment schedule loan period internet rate and anything else that will make it easier for the buyer to fulfill their end of the contract.

Sometimes a floating interest rate will be offered to the buyer which is where the interest rate. They could be. To complete this step we would add one to 001 -- for a total of 101 --- and raise it to the 360th power for a total of 36.

The most favorable terms are zero percent interest with a 10 percent down payment. So one point on a 300000 mortgage would cost 3000 upfront. This is a well-established practice that has become quite common in the owner-financed mortgage arena.

And have an active owner financing promotion. The promissory note is generally entered in the public records so it protects both parties. For instance we buy and sell land across the US.

The interest you pay will likely be higher than you would pay to a bank. Even if a seller is game for owner financing they might not want to be your lender. In the second quarter of 2020 the average auto loan rate for a new car was 431 while the typical used car loan carried an interest rate of 843 according to.

Owner Financing Is Not a Long-Term Solution. As you might expect a financed sale garners a much higher rate of return than many other investment vehicles with a 5-7 year note at 8-10 percent interest as the norm. Investment property mortgage rates are above current market rates.

Theres only a 1 down payment required on all our properties at 0 interest plus no prepayment penalty. It doesnt get much better than 1. The buyer gives the seller a promissory note agreeing to these terms.

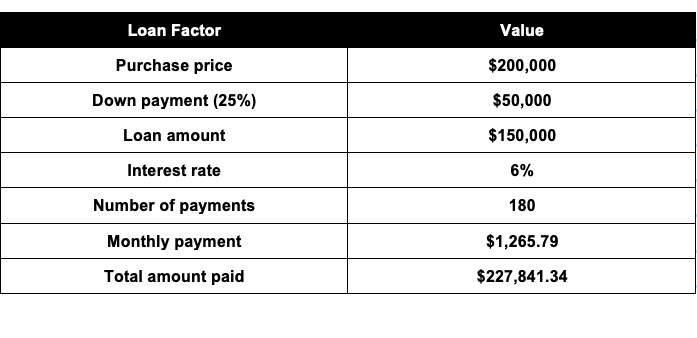

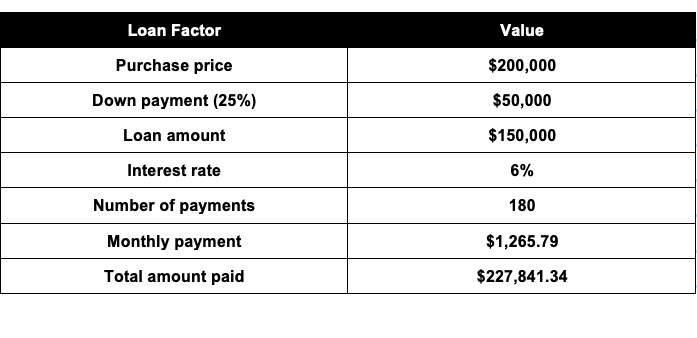

On the flip side you might see a. Its not uncommon to see interest rates from 4 to 10. In our example the interest rate is one percent and the number of payments is 360.

The seller agrees to finance the remaining 55000 at an interest rate of 7 for a five-year term and amortized over 20 yearsresulting in a balloon payment of about 47000 due at the end of. The buyer and seller agree upon an interest rate for the financed portion as well as the monthly payment amount schedule and other details of the loan. If the prevailing 30-year year interest rate is 3 percent then the loan will carry a 275 percent rate because of the point purchase.

IRS Rules on Owner Financing. This takes place when a potential buyer cant obtain the necessary funds through the third-party lenders. For example if a major lender such as Wells Fargo had established current mortgage lending rates of 311 percent a seller may choose to place their owner financing interest rates for 2019 at 48 to 5 percent.

If youre selling financing in states like Missouri and Kansas you can charge a 15 interest rateeven if the going rates are 5 right nowbecause youre making a private sale. Owner financing takes place when a property buyer finances the purchase directly through the person or entity selling it. Multiply the total from step one by the interest rate.

There is typically a substantial down payment required usually 10 percent to 15 percent. To say that seller financing terms range widely is an understatement. The interest rate of a personal loan is the percentage of the loan principal that lenders charge for borrowers to access the loan funds.

When you buy an owner-financed property you may still get the same write offs that you would get if you got traditional bank financing. Owner financing is usually not reported on the buyers credit report. On average personal loan.

Remain firm on charging the amount of interest you feel is appropriate for the market and the level of risk you are assuming.

Seller Financing Contract Template Owner Mortgage Sample Real Estate Hudsonradc

Seller Financing Contract Template Owner Mortgage Sample Real Estate Hudsonradc

Owner Financing Definition Example How Does It Works

Owner Financing Definition Example How Does It Works

Can You Seller Finance A House With A Mortgage Financeviewer

Can You Seller Finance A House With A Mortgage Financeviewer

Free Owner Seller Financing Addendum Pdf Word

Free Owner Seller Financing Addendum Pdf Word

Free Seller Financing Addendum To Purchase Agreement Pdf Word Eforms

Free Seller Financing Addendum To Purchase Agreement Pdf Word Eforms

What Is Owner Financing Bankrate

What Is Owner Financing Bankrate

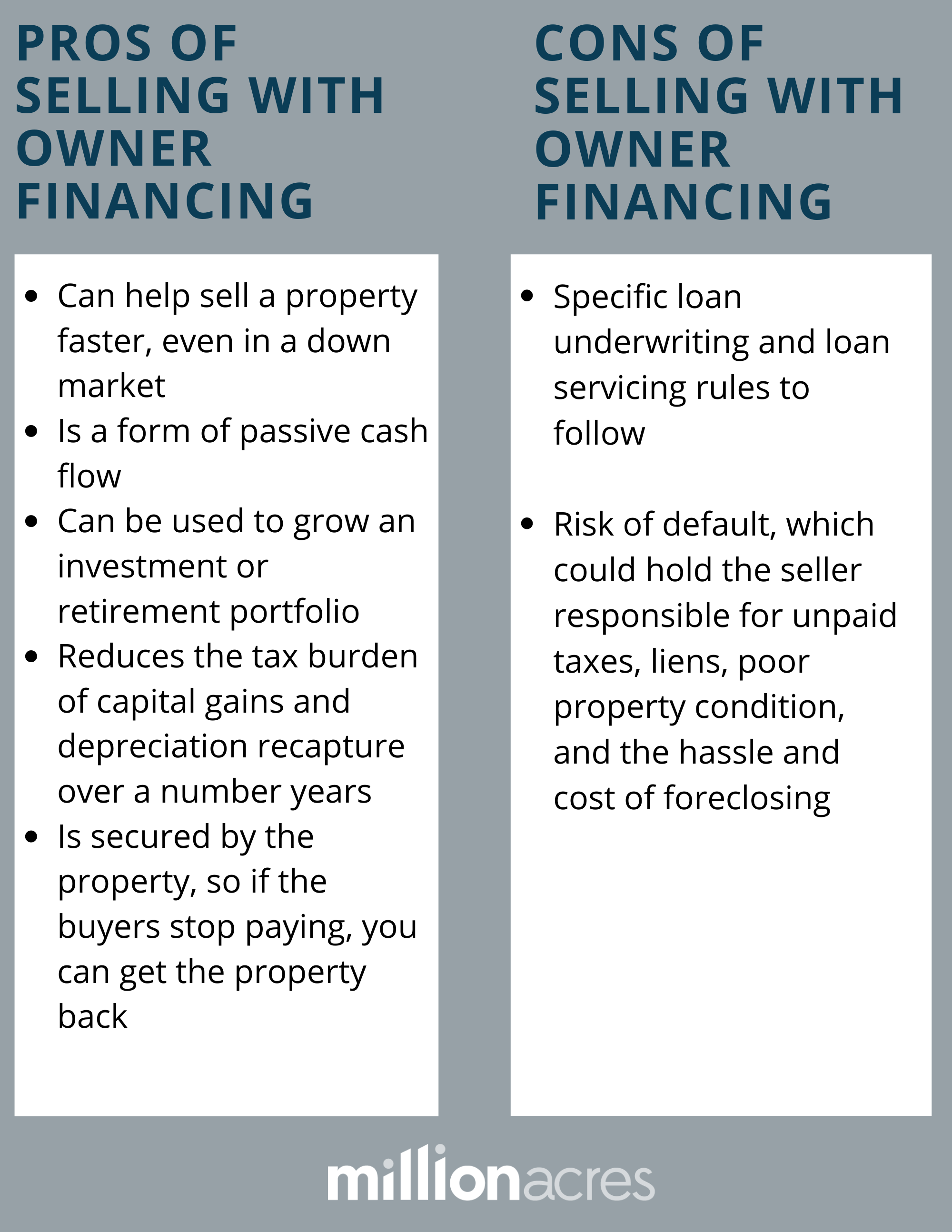

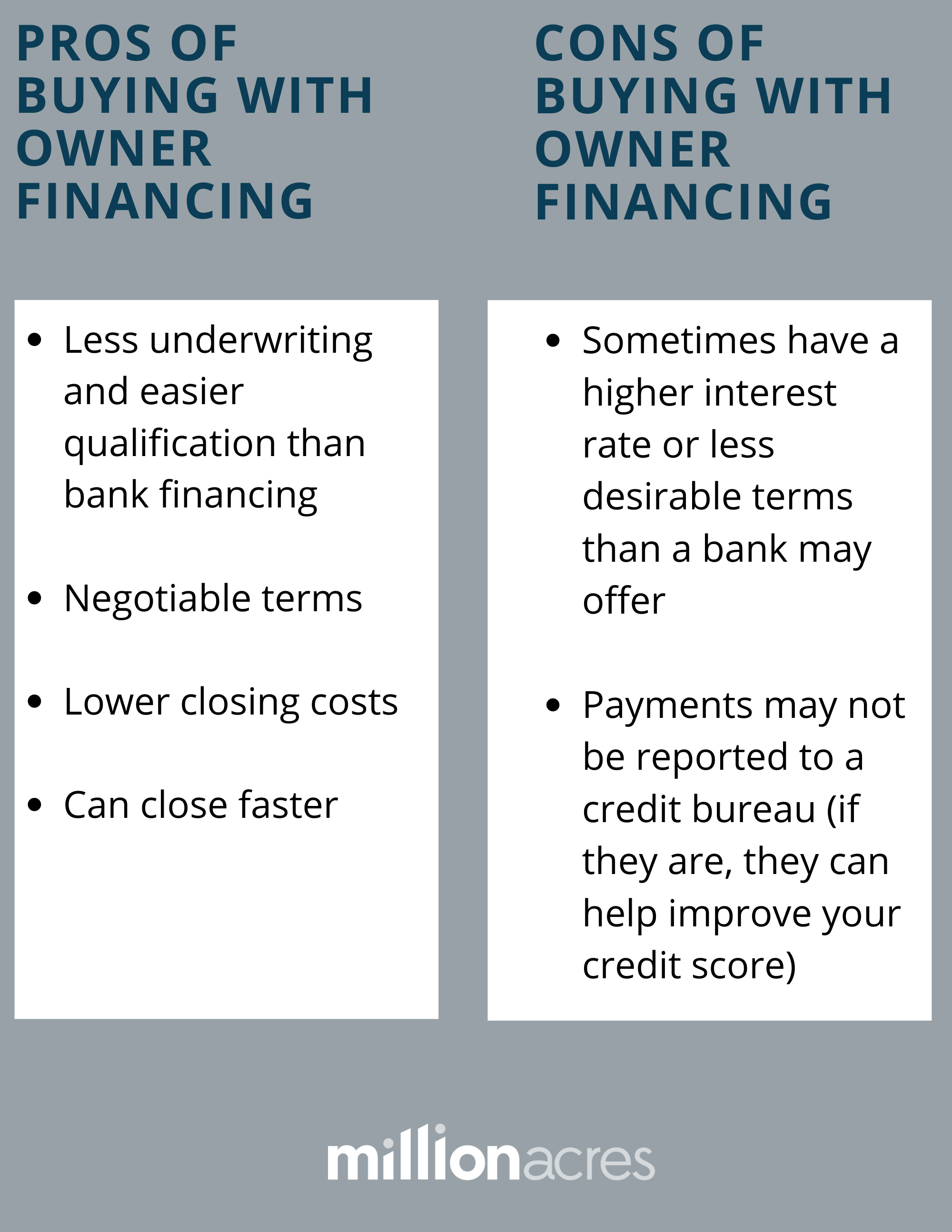

A Guide To Owner Financing Millionacres

A Guide To Owner Financing Millionacres

A Guide To Owner Financing Millionacres

A Guide To Owner Financing Millionacres

Owner Financing Definition Example How Does It Works

Owner Financing Definition Example How Does It Works

Seller Financing Contract Template Business Real Estate Owner Forms Hudsonradc

Seller Financing Contract Template Business Real Estate Owner Forms Hudsonradc

Seller Financing Contract Template Owner Vehicle Business Financed Hudsonradc

Seller Financing Contract Template Owner Vehicle Business Financed Hudsonradc

Owner Financing Contract Template Commercial Real Estate Lease Term Hudsonradc

Owner Financing Contract Template Commercial Real Estate Lease Term Hudsonradc

/A-Guide-to-Owner-Financing-1798416-final-277ef91b6afa404eb05d4bd4b5c857db.png)

:strip_icc()/A-Guide-to-Owner-Financing-1798416-final-277ef91b6afa404eb05d4bd4b5c857db.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.