You can claim head of household filing. Youll need documentation to prove you qualify for this filing status.

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 2018 12 Referenceguide Tax Filing Status And Dependent Rules Pdf

Your spouse was a nonresident alien at any time during the year and you dont choose to treat him or her as a resident alien.

When can you file head of household. You do both of these. You are unmarried recently divorced or legally separated from a spouse. Were unmarried as of December 31 2020 and Paid more than half the cost to run your or a qualifying parents home this year rent mortgage utilities etc and Supported a qualifying person.

You may be eligible to file as head of household even if the child who is your qualifying person has been kidnapped. In order to answer the question its important to keep in mind the criteria to be eligible for head of household status. To qualify for the head of household filing status while married you.

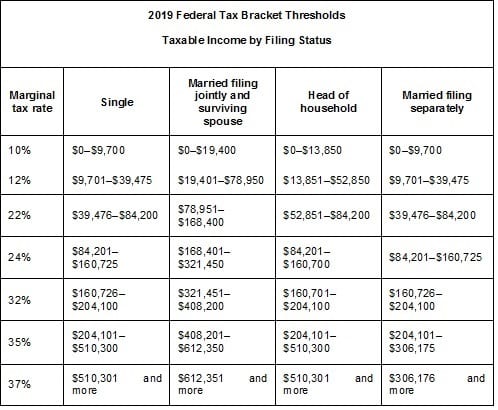

This filing status provides a larger standard deduction and more generous tax rates for. Normally a taxpayer must be unmarried on the last day of the tax year to file as head of household. To file as head of household you must.

To file as head of household you must meet the following criteria. You would still qualify as head of household if youre the custodial parent and your child lives with you more than half the year but youve relinquished the right to claim the child as a dependent for other tax purposes allowing their other parent to do so. This seemingly simple question has a very complex answer.

If you incorrectly file as head of household youll probably hear from the IRS. No you may not file as head of household because you werent legally separated from your spouse or considered unmarried at the end of the tax year. Unmarried as of the last day of the year December 31.

Am I eligible to file as the head of my household. Pay for more than half of the household expenses Be considered unmarried for the tax year and You must have a qualifying child or dependent. If you are single meaning not married on December 31 your filing status could be either single or head of household.

In order to file as head of household you must provide at least 50 of the care received by a dependent such as a child parent brother sister step-parent step-sibling foster child. If you and your spouse plan to share a common household in the future you cant be considered head of household. The rules for filing with the Head of Household status are designed to help single persons with dependents but in some cases married persons can claim the head of household filing status.

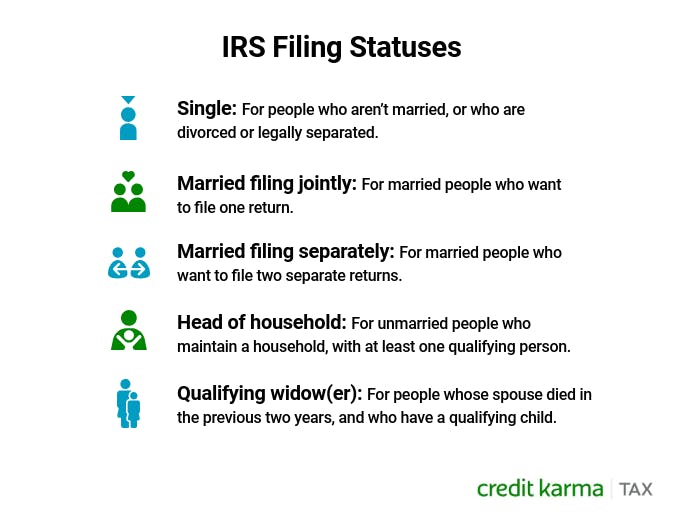

This article was originally published on January 29 2014. Head of household is a filing status for single or unmarried taxpayers who have maintained a home for a qualifying person such as a child or relative. To be considered unmarried at the end of a tax year your spouse may not be a member of your household during the last 6 months of the tax year and you must meet other requirements.

You can qualify for Head of Household if you. If you cant produce proof youll receive a. Sometimes more than one tax filing status may apply to you for a given year.

Even if you arent entitled to claim your child as a dependent you can file as Head of Household as long as youre unmarried paid for more than half the home cost with your child and your child is your qualifying person. This means youre single divorced or legally separated under a separate maintenance decree issued by a state court. File a separate return.

There are three key requirements to qualify as a head of household. Single if you have no dependents and head of household if you have qualifying dependents. The head of household status can lead to reduced taxable income and greater potential for benefits than filing as single.

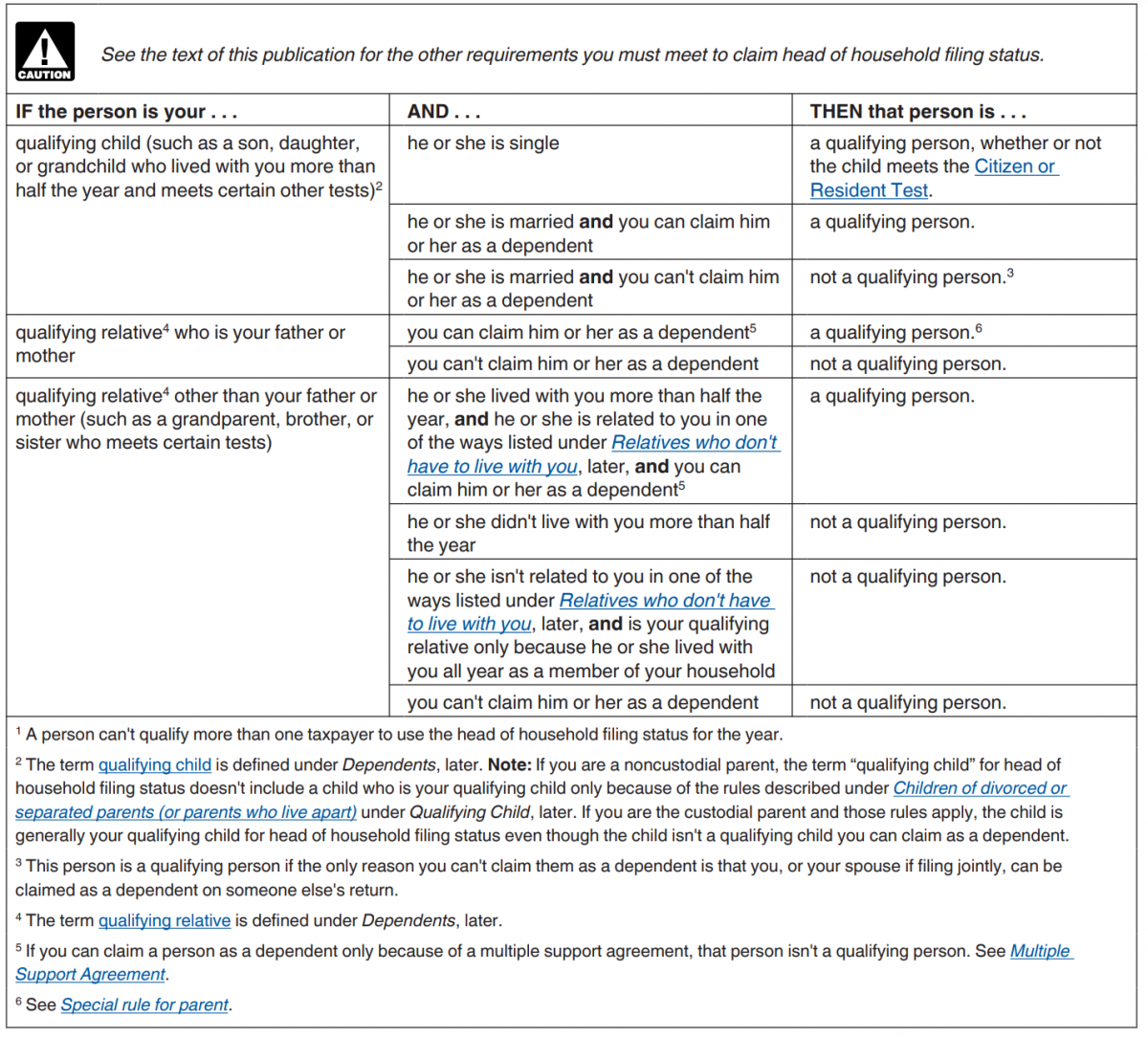

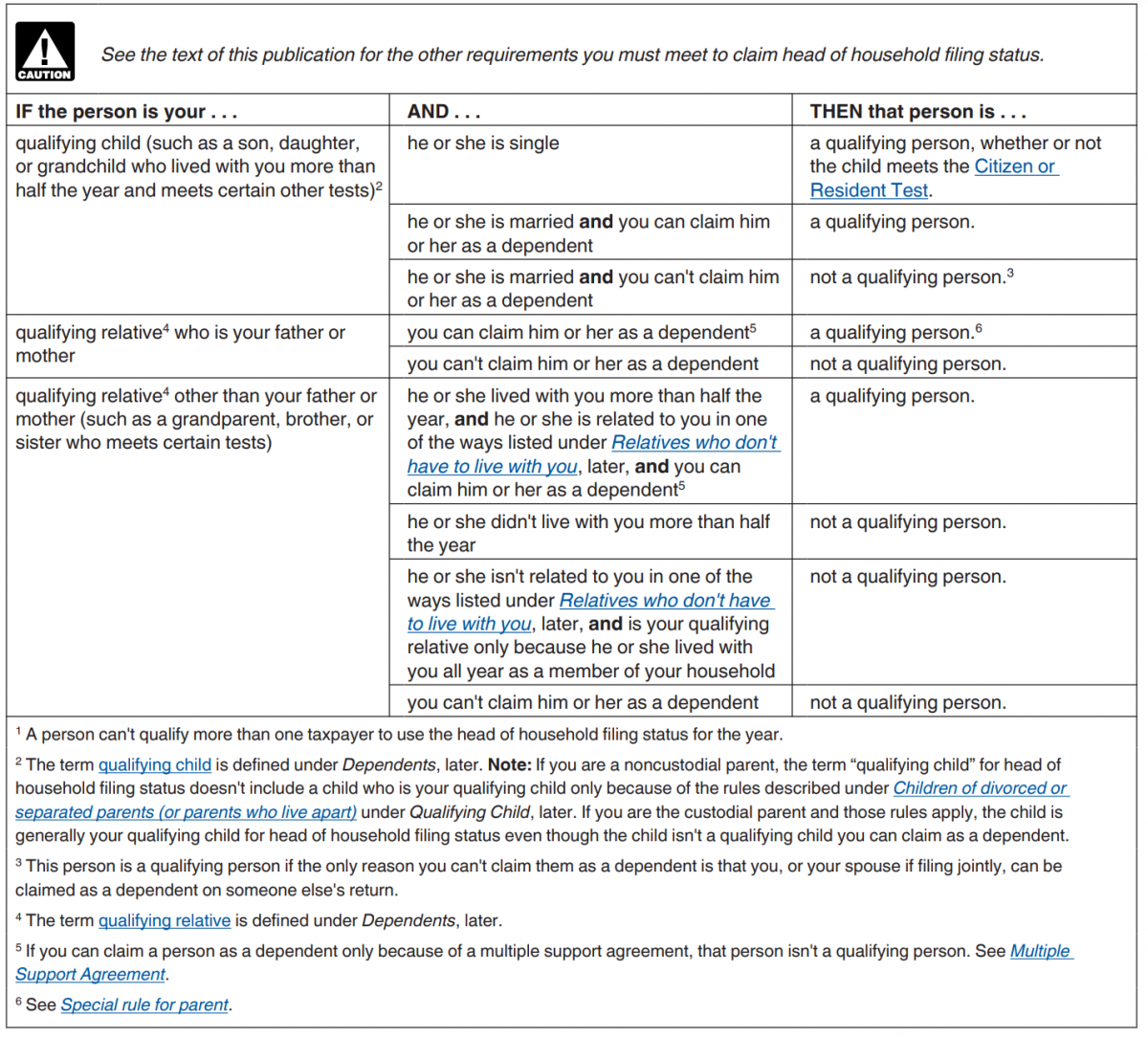

March 26 2018. Can two people who both live at the same address each qualify for the head of household filing status HOH. Who is considered a Qualifying Person.

What Is A Head Of Household Tax Lingo Defined Youtube

What Is A Head Of Household Tax Lingo Defined Youtube

Who Can Claim Head Of Household On Taxes Rules And Penalty Toughnickel

Who Can Claim Head Of Household On Taxes Rules And Penalty Toughnickel

Guide To Filing Taxes As Head Of Household H R Block

Guide To Filing Taxes As Head Of Household H R Block

Taxes From A To Z 2020 H Is For Head Of Household Taxgirl

Taxes From A To Z 2020 H Is For Head Of Household Taxgirl

Learn How An Employee S Filing Status Affects Payroll

Learn How An Employee S Filing Status Affects Payroll

/two-heads-of-household-3193038_final-52aaf4f7fe1245ceaac454b66758f0ab.png) Can Two People Claim Head Of Household At Same Address

Can Two People Claim Head Of Household At Same Address

Qualifying Person Qualifying You To File As Head Of Household Aving To Invest

Qualifying Person Qualifying You To File As Head Of Household Aving To Invest

What Are The Basics Of The Head Of Household Tax Filing Status Purposeful Finance

What Are The Basics Of The Head Of Household Tax Filing Status Purposeful Finance

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png) How To File Your Taxes As Head Of Household

How To File Your Taxes As Head Of Household

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

Better Brackets And Benefits When Filing As Head Of Household Fuoco Group

Better Brackets And Benefits When Filing As Head Of Household Fuoco Group

Filing As Head Of Household What To Know Credit Karma Tax

Filing As Head Of Household What To Know Credit Karma Tax

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.