And because theres an 8-year look back period you can still qualify even if you dont. These are higher limits than before.

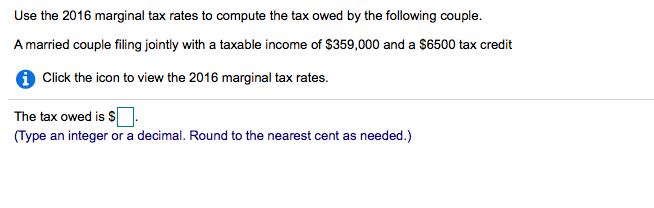

Solved Use The 2016 Marginal Tax Rates To Compute The Tax Chegg Com

Solved Use The 2016 Marginal Tax Rates To Compute The Tax Chegg Com

I just had a buyer lock in a rate of 483 on a 30-year loan.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/6XI6W4SODNE7ZJ3CYWLOXZ7T24.jpg)

6500 tax credit. Buyers who have already owned homes can now qualify for a 6500 tax credit if they purchase a home they intend to occupy. The existing home buyer tax credit is extended until Sept. 125000 a year for individuals 225000 a year for married couples.

Der Weg zu Ihrem 6500 Euro Kredit. 8000 Federal Tax Credit Extended and New 6500 Tax Credit For Repeat Home Buyers. This REMAX of New England press release regarding the 2010 Housing Market Outlook and.

For the following six months buyers can claim half the credit 3750 followed by another six months in which they can claim half that amount 1875. You can save up to 6500 in taxes if you are in a position to take advantage of this new break. The Federal Governments Worker Home ownership and Business Assistance Act of 2009 was signed into law on Nov.

The tax credit is up to 6500 or 3250 for married people filing separate returns. First time home buyers still receive 8000 through April 30 2010 a. This is an easy to follow chart to see if you qualify for the 6500 Tax Credit for Home Buyers.

The homeowners buying the homes must have a binding contract by April 30 2010 and close before July 1 2010 similar to the requirements for the first-time homebuyers. Likewise the tax credit is claimed on IRS Form 5405. 6500 Home Buyer Tax Credit.

March 5 2010 March 5 2010 by Sandcastle Homes posted in Sandcastle News. Here are the requirements for the 6500 home buyer tax credit. 6500 Existing Homeowner TAX CREDIT 6500 tax credithomeowner tax creditmove up creditnew tax credit Author.

2 Interest rates are phenomenally low right now. Einen 6500 Euro Kredit können Sie als Onlinekredit mit Sofortzusage theoretisch in nur wenigen Minuten von zuhause aus beantragen. According to the IRS you do not have to sell your current house which must have been owned and used as a principal or primary residence for at least 5 consecutive years of the 8 year period ending on the date of purchase of a new home as a primary residence in order to take advantage of the new 6500 tax credit for repeat homebuyers so long as the new house becomes your primary house.

6500 Tax Credit for trade-up buyers who already own their own home. Single taxpayer incomes must not exceed 125000 and married couples income can not exceed 225000. That is true stimulasWe are very angry.

After that point buyers have six months to continue receiving the 7500 credit when they buy that brand of EV. There are income limits for these tax credits to apply. The home you buy must be your principal residence.

Posts about 6500 Tax Credit written by todayshomesvermont. Antrag Legitimation Video-Ident und Dokumentenüberprüfung Dokumenten-Upload laufen je nach Kreditangebot komplett digital sodass die 6500 Euro im Idealfall bereits nach 48 Stunden auf Ihrem. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Tagged 6500 Tax Credit 2 story homes Award Winning Home City of Houston family kitchen new homes perfect sandcastle Leave a comment Just Two Months Until the Tax Credit Deadline. By the way if youve been in your home at least 5 of the last 8 years you will likely qualify for a 6500 tax credit if you can get your new home under contract by end of April 2010. Federal Housing Tax Credit Extended.

When we heard of the 6500 tax credit we were excited only to find out that it is not retroactivethe 6500 tax credit should be retroactive for purchases bought in 2009 as it is meant for us homeowners to invest this money back into our homes as it is intended. If you have owned a home for a 5-year period during the last 8 years you can qualify for a tax credit of up to 6500 if you purchase another home before May 1 2010. Some questions are answered regarding the existing or step up buyer home owner tax credit.

Current homeowners can claim a 6500 credit as long as the property they are vacating has been their primary residence for at least five consecutive years out of the last eight years. Credits on Tesla EVs begin phasing out in 2019. You purchased your new home after November 6 2009 and before May 1 2010 or you have a signed contract by April 30 2010 and you must close on the new home by June 30 2010Update.

Its official the 8000 Tax Credit for First Time Home Buyers has Been Extended New 6500 Tax Credit for Current Homeowners Enacted.

1040 2020 Internal Revenue Service

1040 2020 Internal Revenue Service

Publication 596 2020 Earned Income Credit Eic Internal Revenue Service

Publication 596 2020 Earned Income Credit Eic Internal Revenue Service

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Pdf The Effects Of Income On Health New Evidence From The Earned Income Tax Credit

Pdf The Effects Of Income On Health New Evidence From The Earned Income Tax Credit

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

Https Efa Net Eu Wp Content Uploads 2018 12 Efa Tax Survey Report Dec 2018 Pdf

Igst Refunds Exporters Claim Rs 6500 Cr In July October Period The Financial Express

Igst Refunds Exporters Claim Rs 6500 Cr In July October Period The Financial Express

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/6XI6W4SODNE7ZJ3CYWLOXZ7T24.jpg) If You Worked In 2019 You Could Be Missing A Valuable Tax Credit Here S How To Get It

If You Worked In 2019 You Could Be Missing A Valuable Tax Credit Here S How To Get It

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is The Standard Deduction Tax Policy Center

What Is The Standard Deduction Tax Policy Center

Virginia S Education Improvement Scholarships Tax Credits Program Ppt Download

Virginia S Education Improvement Scholarships Tax Credits Program Ppt Download

Irs Tax Credits And What To Be Aware Of E File Com

Irs Tax Credits And What To Be Aware Of E File Com

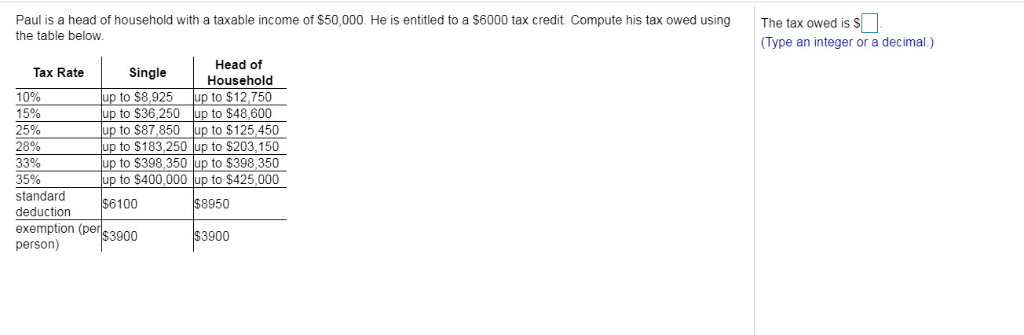

Solved Paul Is A Head Of Household With A Taxable Income Chegg Com

Solved Paul Is A Head Of Household With A Taxable Income Chegg Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.