Flat rate means you will pay one rate for the preparation of your taxes. Innovation and technology are rapidly changing the very basics of how bookkeepers and accountants fulfill their duties to their clients.

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Fees for limited companies can vary from as little as 100 to well over 1000 a month depending on the size and complexity of their businesses.

What do tax accountants charge. Tax return unincorporated 200 to 500 Tax return incorporated 800 to 1800. According to a 2019 survey the National Society of Accountants says that you should expect to pay an average of 294 if you itemize your deductions on your tax return. The average cost of hiring a tax professional ranges from 146 to 457.

The 2021 average cost of tax preparation is 175 with prices typically ranging from 150-200. Taxpayers without itemized deductions pay an average of 152. 175 for up to 1 hour of time with CPA.

The average fee charged to prepare an itemized Form 1040 with Schedule A and a state tax return is 273 and the cost for a Form 1040 without. Purchasing tax accounting software can be a less expensive option. How much does CPA charge.

Before you gulp you can take some comfort in knowing that this generally includes both your state and federal returns. To get quotes from 3-4 local accountants with experience of working with businesses like yours please fill in the form towards the top of the page. Accountants charge businesses 218 to prepare and file Form 1040 with Schedule C.

Staff Accountant hourly rate. The IRS does not require accountants to pay any taxes due as a result of additional assessments made as a result of the audit so it is important youre prepared to discuss any questions the. Irs Resolution Audit Support 175 per hour.

Consultation 175 per hour. Federal or State Correspondence 175 per hour. Mar 9 2021.

The rates can be as low as 25 per hour or as high as 300 per hour. While you might have a tax accountant who can help you in this regard it certainly doesnt hurt to use nonprofit tax software to make things even less stressful for you and your organization. Certified Public Accountant CPA 175 per hour.

Tax Accountant hourly rate. Other average charges range from 44 to file an individual tax extension to 806 to prepare and file Form 1120 for corporations. However costs can reach as high as 450.

On the low end individual tax preparation fees start at 100. The starting point must be the engagement letter which is considered in more detail in the article on Communication later in the series. The accounting industry is changing dramatically.

To give you an idea of the comparison of other professional accounting fees to that of a certified public accountant take a look at the averages below. This fee does not apply to current. Additionally a tax accountant analyzes financial information and assist all departments are well-informed of the current best practices in the field of accounting.

The National Society of Accountants asks its members about the fees they charge and according to its 2016-2017 fee survey the average fee to prepare and file. Senior Accountant hourly rate. How much do accountants charge to do taxes You may only need an accountant for an occasional project such as tax preparation.

A tax accountant is valuable to the accounting and finance. For personal returns which are more standardized you can expect a total fee between 400 and 500 for your IRS 1040 return and associated forms. File990 is the ideal platform to file Form 990-N in particular as you can easily fill out and submit the form in minutes and do so in the most.

A tax accountant plays a vital role in preparing and submitting tax forms. As we see the cloud emerging and expanding in practices we need to revisit how we have traditionally charged for professional services. Over the years accountants have used many different means of deciding how much to charge clients for the work that they have carried out.

According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state income tax. Accountant non-CPA hourly rate.

Hiring An Accountant To Do Your Taxes Vs Using Turbo Tax Or Tax Cut

Hiring An Accountant To Do Your Taxes Vs Using Turbo Tax Or Tax Cut

Pricing Billing And Collecting Fees

Pricing Billing And Collecting Fees

Fee Structure Tax Preparation Fees Wcg Cpas

Fee Structure Tax Preparation Fees Wcg Cpas

How Much Does An Accountant Cost For A Small Business

How Much Does An Accountant Cost For A Small Business

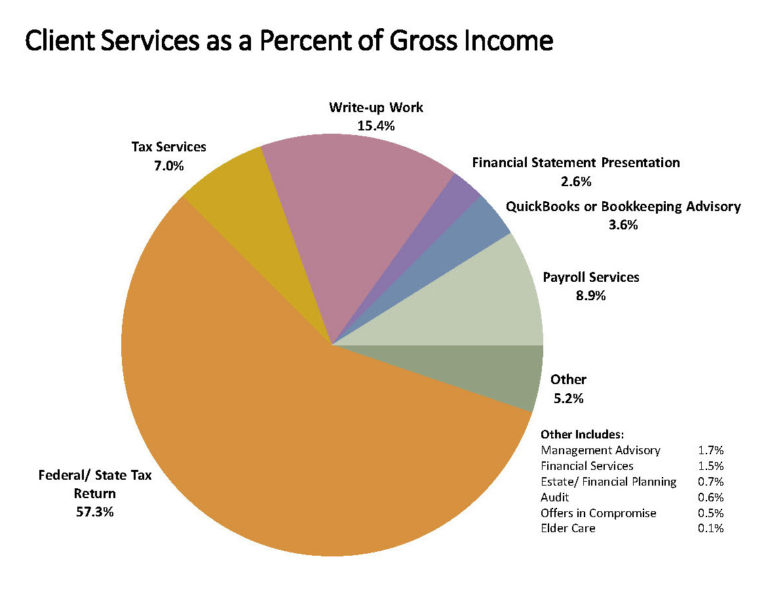

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

How To Find An Accountant To Do Your Tax Return And What You Should Pay Self Assessment Tax The Guardian

How To Find An Accountant To Do Your Tax Return And What You Should Pay Self Assessment Tax The Guardian

How Much Should Accounting Cost A Small Business Costs Averages

How Much Should Accounting Cost A Small Business Costs Averages

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Pricing Billing And Collecting Fees

Pricing Billing And Collecting Fees

How Much Do Accountants Charge For Tax Preparation Tax Preparation Tax Tax Forms

How Much Do Accountants Charge For Tax Preparation Tax Preparation Tax Tax Forms

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

What Do Accountants Charge For Small Businesses

What Do Accountants Charge For Small Businesses

Average Tax Preparation Fees Hit 273 For 1040 And One State Cpa Practice Advisor

Average Tax Preparation Fees Hit 273 For 1040 And One State Cpa Practice Advisor

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.