If you qualify as head of household you can use the head of household column in the Tax Table or the head of household Tax Rate Schedule. Head of household is also a filing status for federal income taxpayers in the US.

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

In order to file as head of household you must provide at least 50 of the care received by a dependent such as a child parent brother sister step-parent step-sibling foster child.

Define head of household. Get a Head of Household mug for your mom Sarah. The designation head of household also termed head of family is applied to one whose authority to exercise family control and to support the dependent. Define head of household.

The designation head of household also termed head of family is applied to one whose authority to exercise family control and to support the dependent. The Head of Household filing status is designed to give single or separated parents an extra financial boost. Head of Household defined for FAFSA.

4 In most datasets a household head is defined as the male of a couple and a reference person or householder as the person in whose name the residential unit in which the household lives is rented or owned. If the marital status of the student andor parents is inconsistent with the marital status reported on the FAFSA that will represent conflicting information that must be resolved before aid can be disbursed. Head of household synonyms head of household pronunciation head of household translation English dictionary definition of head of household.

Head of household is a filing status for single or unmarried taxpayers who have maintained a home for a qualifying person such as a child or relative. An individual in one family setting who provides actual support and maintenance to one or more individuals who are related to him or her through Adoption blood or marriage. Head of Household is a filing status for single or unmarried taxpayers who keep up a home for a Qualifying Person.

Survey respondents are typically asked to name the family member who is the head of the household the reference person or the householder. Citizens and Resident Aliens Abroad - Filing Requirements. Publication 501 Exemptions Standard Deduction and Filing Information.

An individual in one family setting who provides actual support and maintenance to one or more individuals who are related to him or her through Adoption blood or marriage. Head of household means a dependent childs parent or the spouse of the parent or the dependent childs nonparent relative or spouse of the nonparent relative who receives cash assistance for himself and on behalf of the dependent child or only on behalf of the dependent child. A dependent parent who lived with you for at least half of the year or whose household you paid 50 percent of the cost to support.

The Head of Household filing status has some important tax advantages over the Single filing status. Jun 6 Word of the Day. Single or separated individuals get a smaller s.

The person in the house who is responsible for making decisions and earning money Comments on head of the household What made you want to look up head of the. Or a sibling or one of his or her descendents if he lived in your home for at least six months of the year and you can claim him as an exemption. The designation head of household also termed head of family is applied to one whose authority to exercise family control and to support the dependent members is founded upon a moral or legal obligation or duty.

Head of household - the head of a household or family or tribe chief top dog head - a person who is in charge. Definition of head of the household. True of COVID-19 sufferers and of George Floyd.

A qualifying dependent can be your child stepchild foster child or one of their descendents. Qualifying for head of household status means meeting a series of interlocking rules involving your marital status paying for more than half your households expenses and having a dependent. The IRS will consider this person the sole provider of the household.

The individual in a household with the highest income. This filing status provides a larger standard deduction and more generous tax rates. If you qualify as Head of Household you will have a lower tax rate and a higher standard deduction than a Single filer.

I cant breathe unknown.

Description Of The Variables Explanatory Variables Definition Household Download Table

Description Of The Variables Explanatory Variables Definition Household Download Table

How To Know When You Should File Jointly Head Of Household Or Single

How To Know When You Should File Jointly Head Of Household Or Single

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

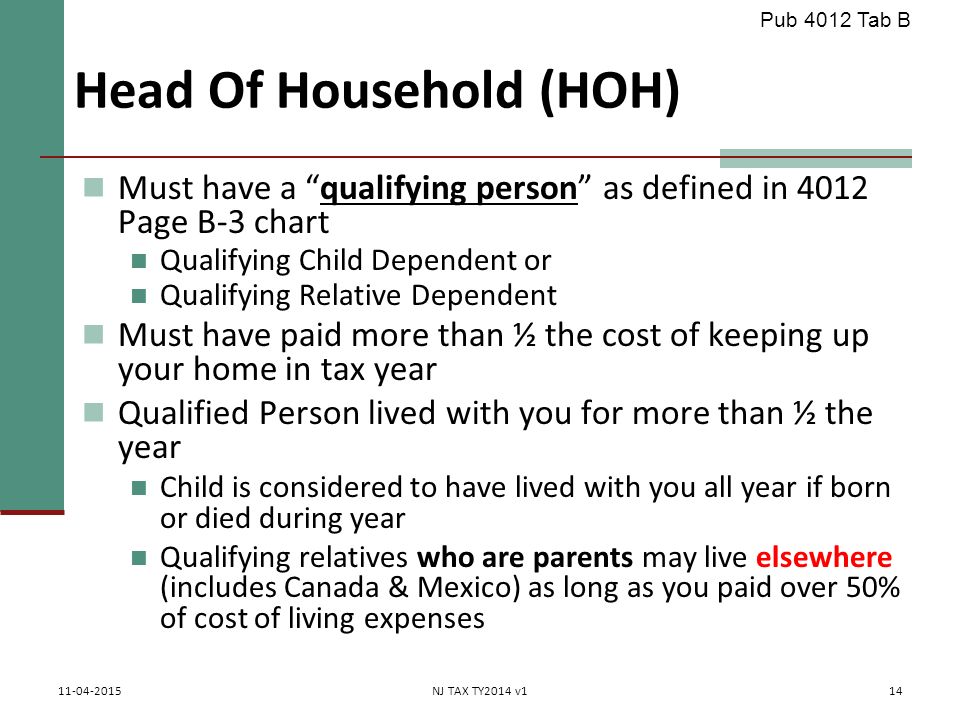

Nj Special Handling Document On Taxprep4free Org Ppt Video Online Download

Nj Special Handling Document On Taxprep4free Org Ppt Video Online Download

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png) How To File Your Taxes As Head Of Household

How To File Your Taxes As Head Of Household

Guide To Filing Taxes As Head Of Household H R Block

Guide To Filing Taxes As Head Of Household H R Block

Head Of Household Definition Filing Requirements And Advantages

Head Of Household Definition Filing Requirements And Advantages

Guide To Filing Taxes As Head Of Household H R Block

Guide To Filing Taxes As Head Of Household H R Block

Household Definition Head Member Of Household

Household Definition Head Member Of Household

/taxesfeb15013-5bfc2ce046e0fb005119e979.jpg) What Does Filing As Head Of Household Mean For Your Taxes

What Does Filing As Head Of Household Mean For Your Taxes

Head Of Household Filing Status Definition Rules 2020 Smartasset

Head Of Household Filing Status Definition Rules 2020 Smartasset

Head Of Household Filing Status Definition Rules 2020 Smartasset

Head Of Household Filing Status Definition Rules 2020 Smartasset

Head Of Household Filing Status Is For Most Single Parents

Head Of Household Filing Status Is For Most Single Parents

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.